Is This Company The Future?

SCROLL DOWN TO SEE OUR NEW FEATURED STOCK ⬇

Do you want

FREE LOW FLOAT STOCK PICKS?

Do you want potential

EXPLOSIVE TRADES?

Do you want

MUST WATCH STOCKS?

NASDAQ: $ZENA

- 98% Recurring Revenue from Over 100 Enterprise SaaS Customers

- AI Drone and Enterprise SaaS Solutions Serving Government and Industrial Sectors

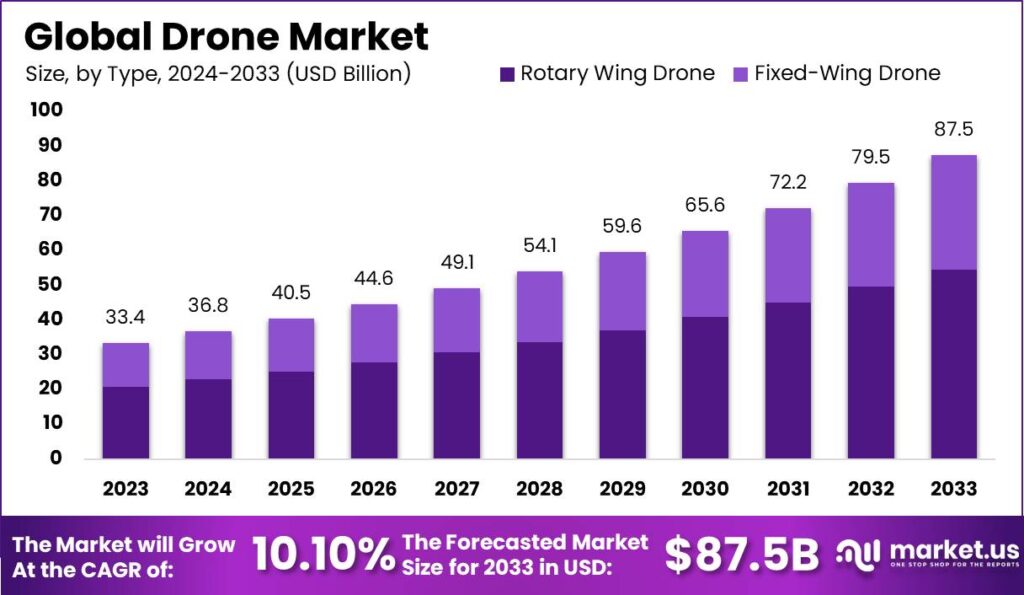

- Participating in a Commercial Drone Market Expected to Grow to $82.5B by 2032

- Secured Contracts with U.S. Air Force and Navy for Drone Operations

- Global Team of 100+ Engineers and Developers Across North America, Europe, and South America

- Patented Drone Technology for Advanced Scanning and Heavy-Lift Capabilities

- Multiple Revenue Streams Including Drone-as-a-Service (DaaS) and SaaS Models

Key Aspects For $ZENA Investors

Product Offering: ZenaTech offers cutting-edge AI drone and enterprise SaaS solutions for mission-critical applications in various industries, including agriculture, defense, and logistics. Its ZenaDrone products feature advanced scanning, heavy-lift capabilities, and multiple attachments, integrating seamlessly with enterprise software for security, compliance, and operational management.

Growth Projections: The commercial drone market is expected to grow at a compound annual growth rate (CAGR) of 25.82%, reaching $82.5 billion by 2032. ZenaTech is positioned to capitalize on this growth with its patented drone technology and strong customer base across government and industrial sectors.

Management and Legal Dynamics: Led by CEO Shaun Passley, PhD, with over 25 years of experience in the software industry and extensive expertise in public company leadership, ZenaTech is managed by a highly qualified team. The company’s global team includes mechanical engineers, software developers, and drone specialists focused on driving innovation and expansion.

Competition and Market Position: ZenaTech operates in a highly competitive but rapidly growing sector, facing competition from global drone technology providers. However, its patented technology, proven partnerships with U.S. government agencies, and focus on integrating AI with hardware solutions give it a strong competitive advantage.

Investment Risks and Performance: The drone technology sector is subject to rapid changes in regulation and market demand. While ZenaTech has secured key contracts and partnerships, market volatility and competition could impact future revenue growth. However, the company’s 98% recurring revenue from SaaS customers provides a solid foundation.

Regulatory and Governance Concerns: ZenaTech has received regulatory approval in key markets like the U.S. and UAE, with pending applications in Europe and Canada. As with any innovative technology company, there may be regulatory challenges, especially concerning drone usage in sensitive industries such as defense and agriculture.

Zena Is Early In A High Growth Industry

Zenatech Has regulatory apporval in the usa

The U.S. Commercial Drone Market Is Set To Expand Rapidly

Trader Notes $zena

Innovative Leader in Drone Technology

ZenaTech is at the forefront of the AI-driven drone industry, offering next-generation solutions for enterprise applications across agriculture, defense, and logistics. Its strong market presence positions it as a key player in the rapidly expanding commercial drone sector.

Strong Market Growth Potential

With the global commercial drone market expected to reach $82.5B by 2032, ZenaTech’s unique combination of AI, software integration, and hardware capabilities creates significant growth opportunities for the company in the near future.

Government Contracts and Expanding Partnerships

ZenaTech has already secured paid pilot programs with the U.S. Air Force and Navy. As it expands its partnerships across North America and Europe, the company is poised to benefit from government contracts and favorable policy shifts.

High Short-Term Volatility, Long-Term Growth

Due to its involvement in cutting-edge technology and government sectors, ZenaTech’s stock could experience short-term volatility. However, its strong revenue model and innovative product offerings point to long-term sustainable growth.

THE HYPE IS REAL

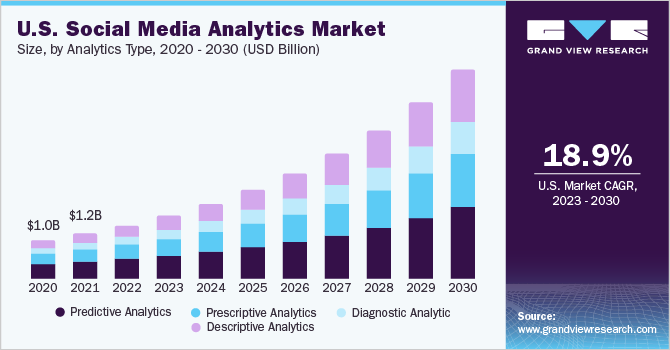

Social media trends are expected to SURGE in the next 5 years and new platofrms such as Truth Social could gain some serious momentum!

CLICK HERE AND SIGN UP NOW!

Disclaimer

DISCLAIMER

We the publisher (WE) offers no guarantees and provides forward looking statements with intentions and sole purpose to satisfy the reader/viewer by offering only personal enjoyment and personal entertainment. If at any time a Security is purchased that is discussed at WE on a written article, post, newsletter or comment, you agree to hold WE liability free and harmless. There are no guarantees in participating in Financial Markets and full investment can be fully lost at any time. WE never guarantees and never offers recommendations. The company will not be responsible for any loss or damage that occurs. Anyone at WE may be buying or selling any stock mentioned at any given time.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any WE Service and product offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. WE recommend you consult a licensed or registered professional before making any investment decision as you could lose your full investment at any given time as this is not a “risk free” industry. If you do agree to this, then please exit our website now.

WE are NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Both, WE nor any of its owners or employees are registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. We do NOT give out advice, this is intended to be ONLY a publication for information and education.

Market Impact and Risks: Understand that any increases in trading volume or share price due to this advertisement and marketing efforts may be temporary, with potential declines post-advertising period. While the publisher endeavors to provide accurate and unbiased information, readers are urged to verify details independently and seek professional financial counsel before making decisions regarding the mentioned securities.

Investment Risks and Professional Advice: Investing involves inherent risks, including potential loss of principal. Historical performance does not guarantee future results. Consulting with a qualified financial advisor is strongly recommended before making any investment decisions.

Publisher’s Activities: The publisher retains the right to engage in buying or selling securities at any time, which may or may not be disclosed at the time of publication.

Forward-Looking Statements: This publication may contain forward-looking statements about expected market performance and financial outcomes. These statements are subject to risks and uncertainties that could cause actual results to differ significantly from those expressed or implied.

No Endorsement: The mention of ABVE or any other securities within this publication does not constitute an endorsement or recommendation by the publisher or its affiliates. The publisher disclaims any responsibility for investment decisions made by readers based on the provided information.

Solicitation and Recommendation: The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities should always do so only with the assistance of his legal, tax, and investment advisors.

Investor Resources: Investors should review any information concerning a potential investment at the websites of the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov; the Financial Industry Regulatory Authority (the “FINRA”) at www.finra.org, relevant State Securities Administrator websites, and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by FINRA on how to invest carefully.

Compensation Notice: The owners of this publication were compensated $25,000 on October 18th by ZenaTech (NASDAQ: Zena) for coverage of ZenaTech from October 18th to November 18th. This compensation support the distribution of digital marketing strategies, including social media articles, ticker tag articles, podcast, videos and other content aimed at increasing investor awareness surrounding ZenaTech.

Verification of Information: Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

By reading this disclaimer, you acknowledge and accept the terms and conditions outlined herein. Make informed decisions and proceed with due diligence.